The Strong Appeal of Select-Service Hotels

Dipika Patel

Co-Founder

GreatX

Co-Founder

- Location: USA

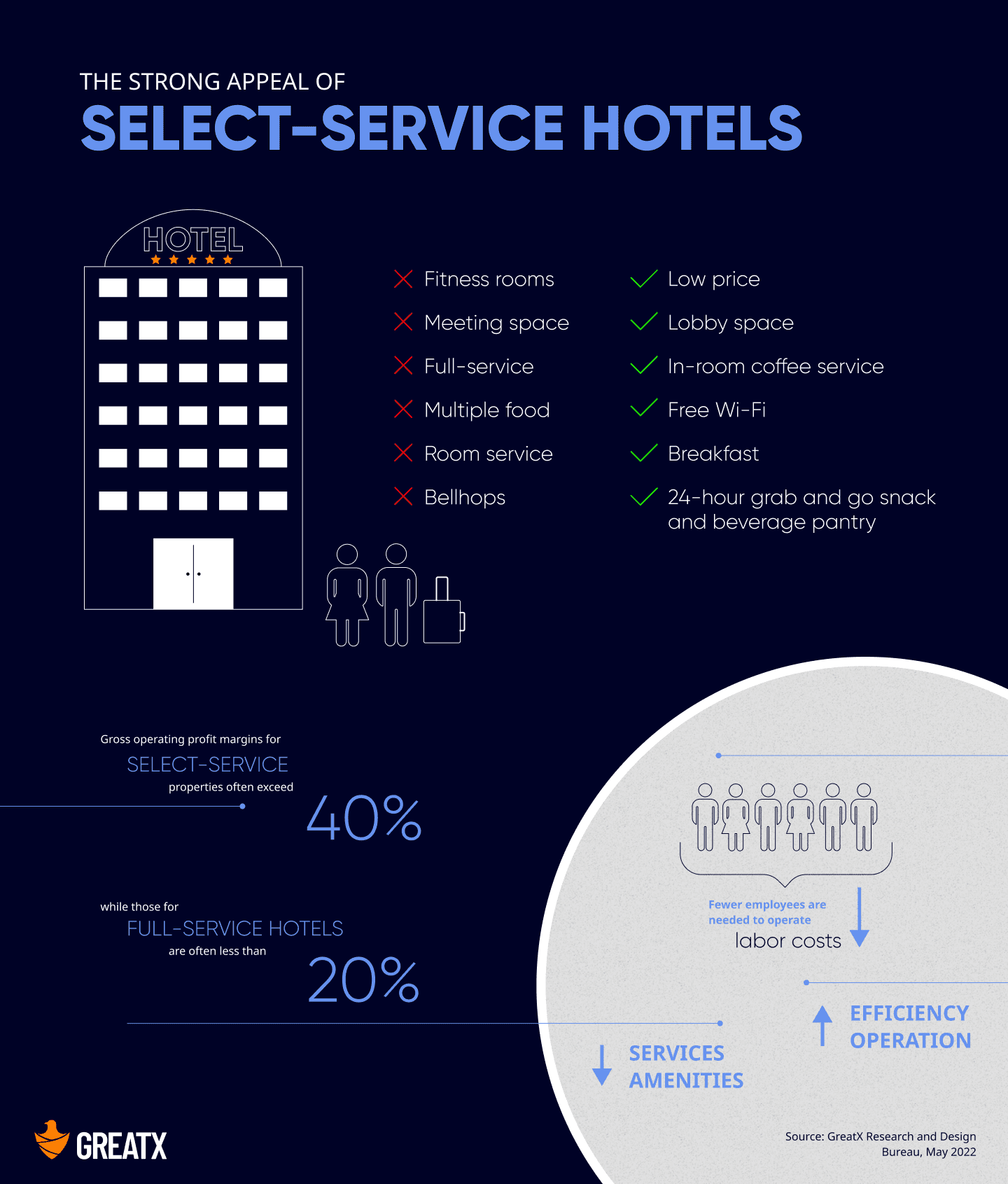

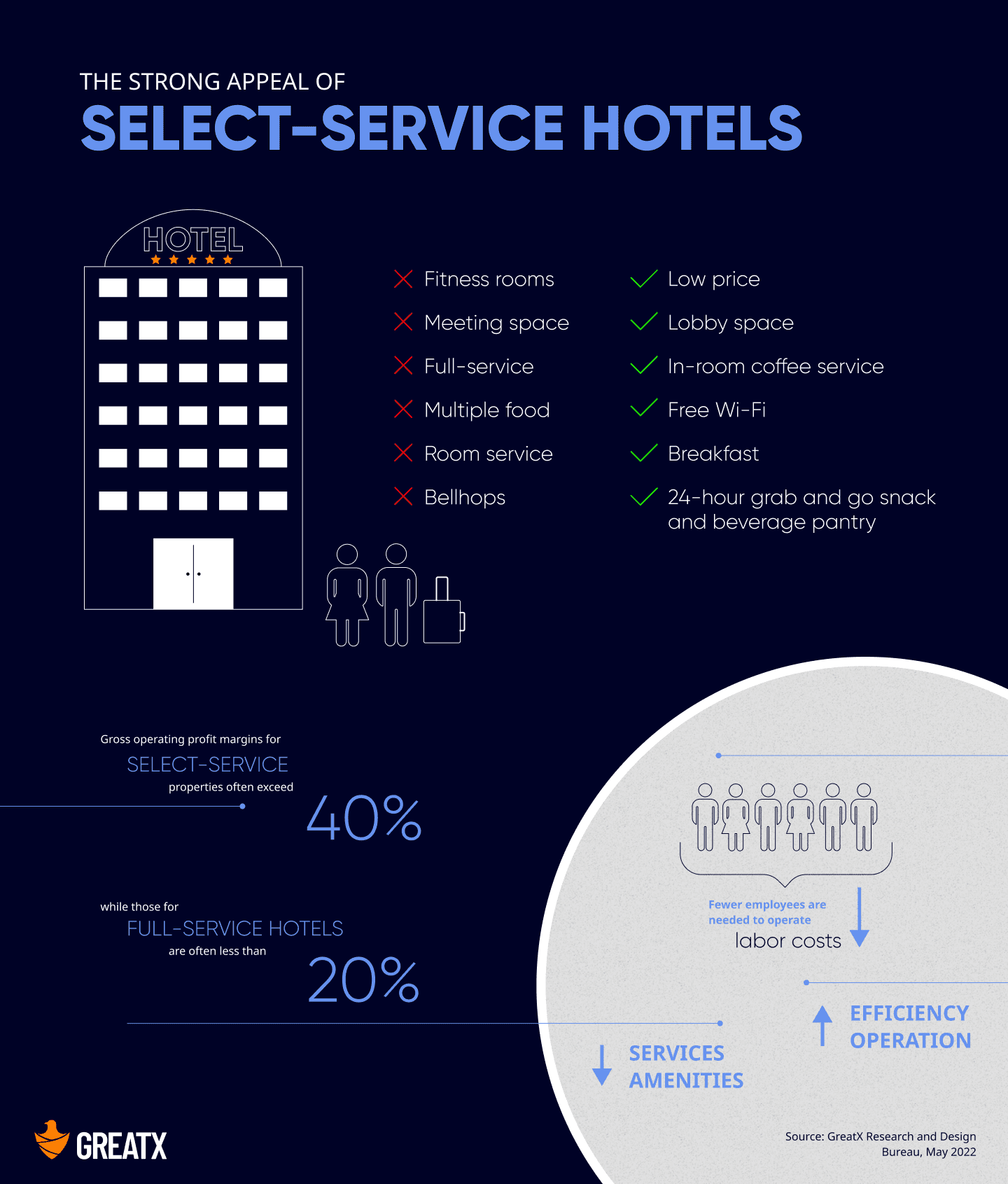

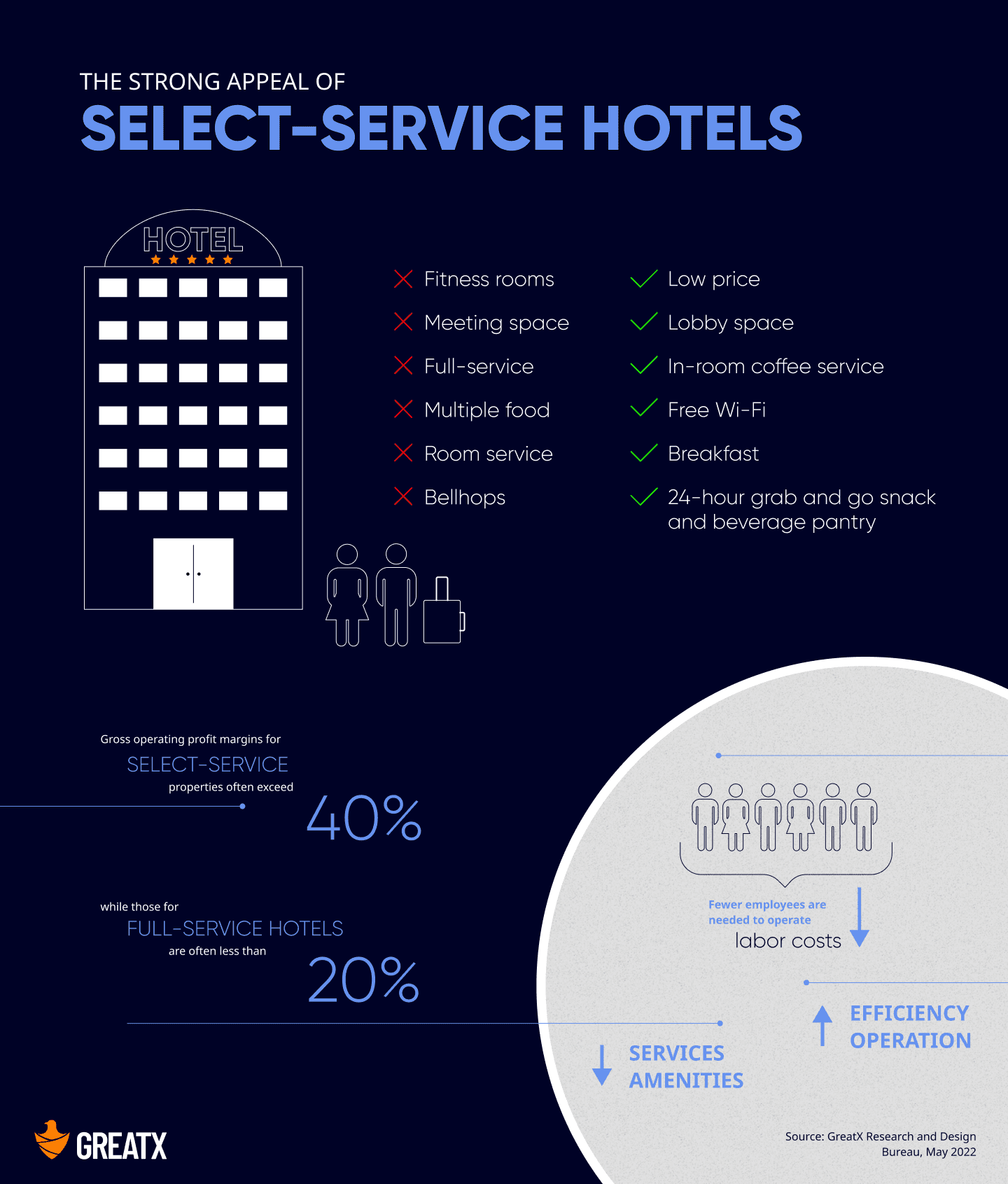

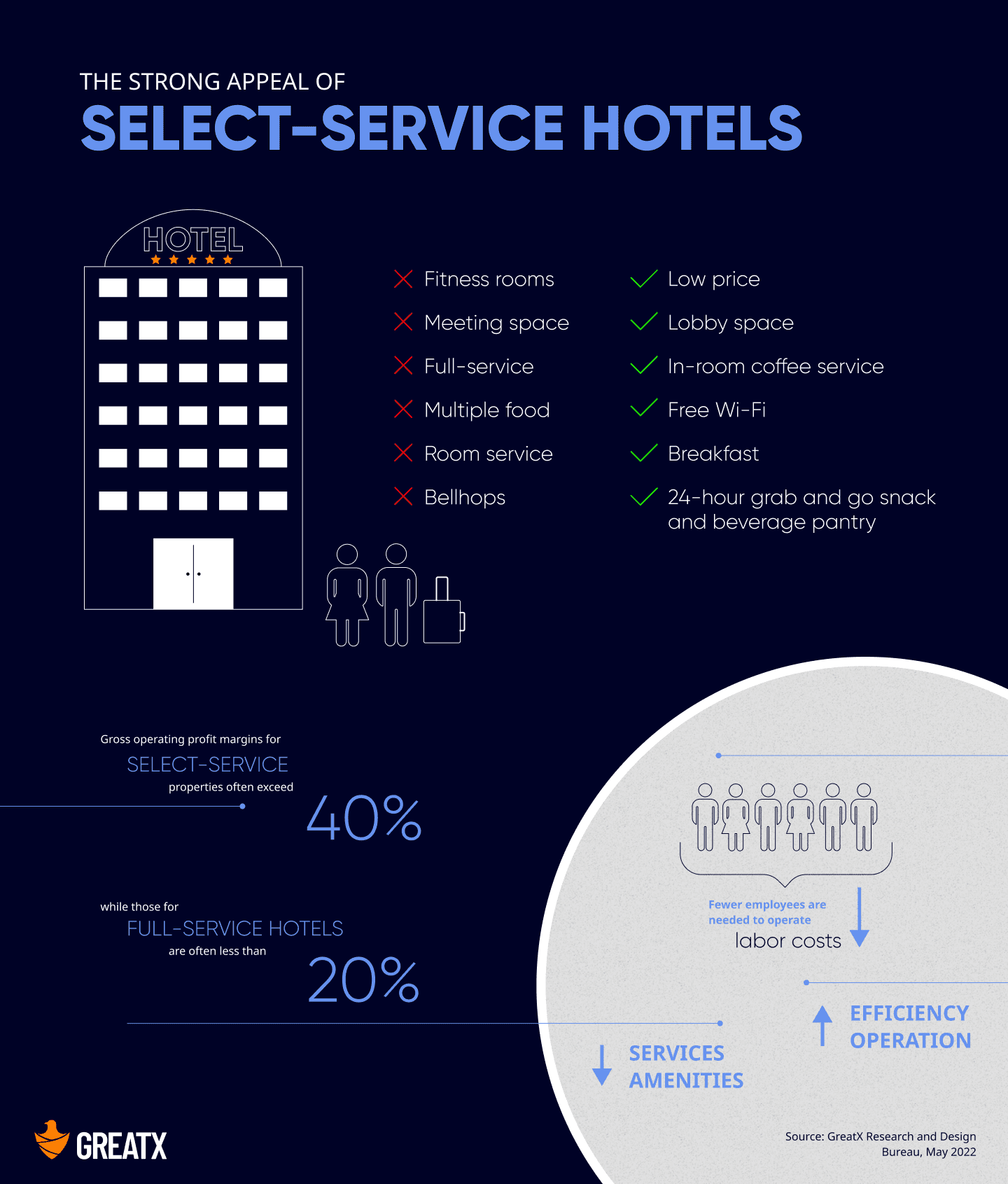

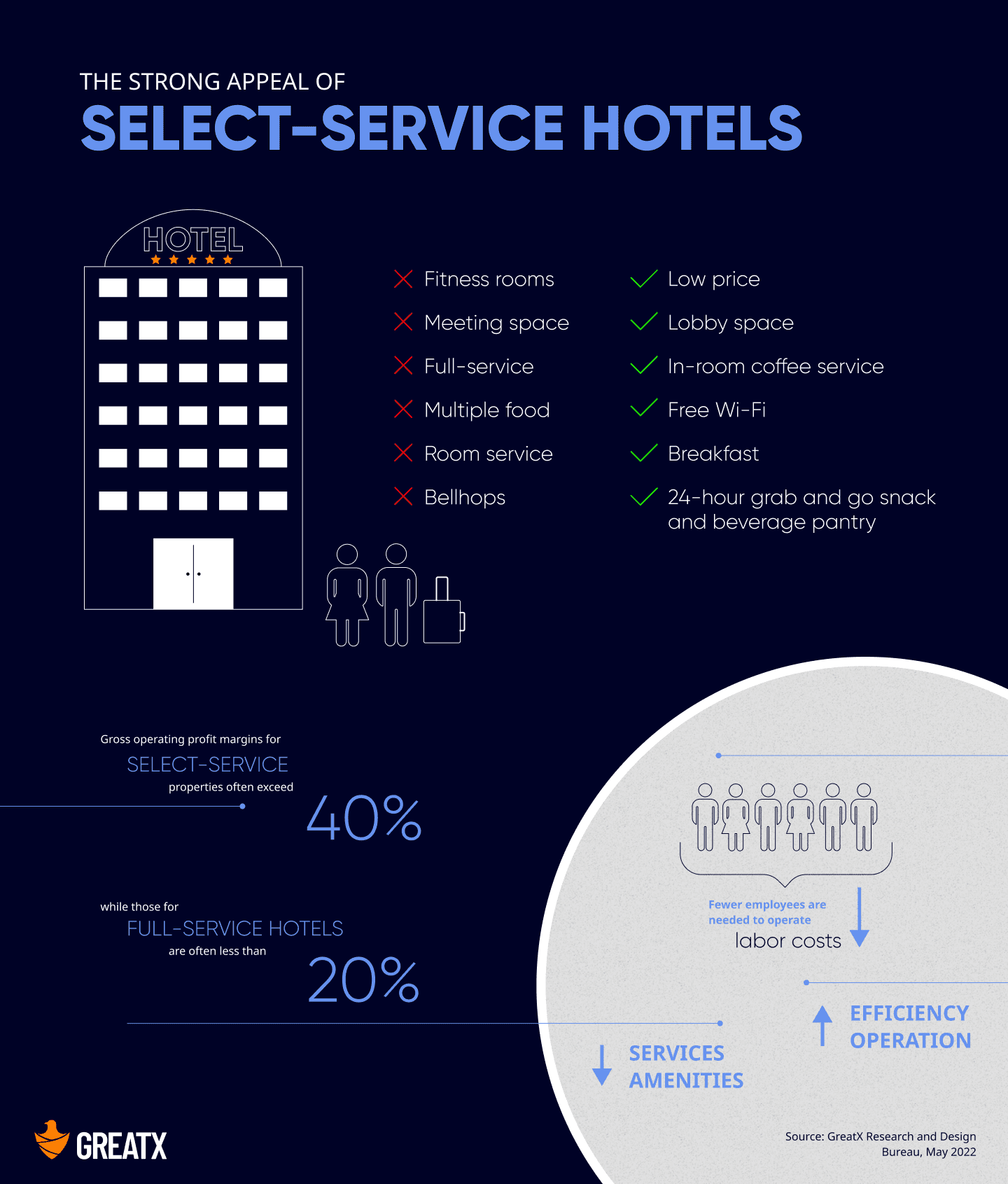

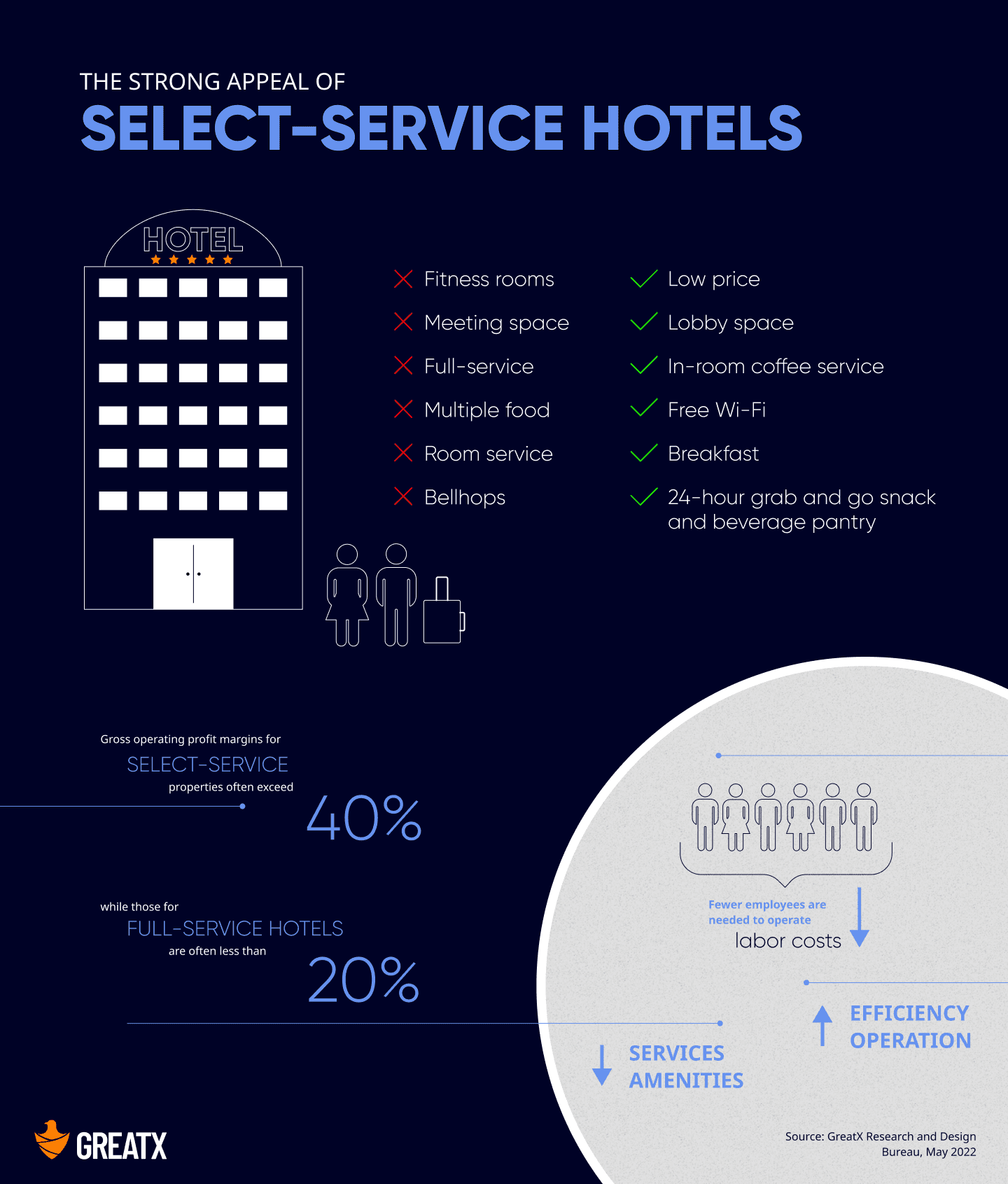

The select-service segment is one of the most favored segments of the lodging industry. As the name suggests, select service hotels are hybrid assets in that they offer more amenities than limited-service properties, such as fitness rooms and limited meeting space but lack some of the facilities and services offered by full-service properties like multiple food and beverage outlets, room service, concierge assistance and bellhops.

Travelers often prefer select service properties because of the value and convenience they offer. Select service average daily rates are typically lower than those at full-service hotel sand operations are more streamlined. In addition, select-service properties offer guestrooms that are often of a quality level equal to or better than that of upscale, full-service hotels with all the essential amenities, such as in-room coffee service and free Wi-Fi. While select-service hotels have only limited food and beverage service, most offer breakfast, a 24-hour grab and go snack and beverage pantry, and lobby space where guests can socialize.

From the investment perspective, because select-service hotels offer fewer services and amenities, they are easier and more efficient to operate. Fewer employees are needed to operate these hotels so labor costs, one of the most expensive components of hotel operations, tend to be meaningfully lower. As a result, select service properties generate higher and more stable operating margins than full-service hotels. Gross operating profit margins for select-service properties often exceed 40%, while those for full-service hotels are often less than 20%. The rich margins have afforded the segment downside risk protection and durable income streams through economic cycles, especially for experienced owner operators like GreatX.

Although COVID-19 has had a dramatic impact on the hospitality industry overall, select service hotels have been second only to extended stay properties in leading the post-COVID lodging recovery. From an occupancy perspective, because select service hotels are less dependent on group business, they benefit from more consistent demand than other segments. It is expected that this occupancy trend will be aided by continued limited new construction driven by increased building costs and supply chain constraints. In addition, today’s high inflationary environment is leading to higher average daily rates, resulting in increased top line revenue for these properties. This, coupled with the skinny operating expenses associated with select-service hotels is resulting in operating margin recovery. While CBD business travel is still slow, select service properties are benefitting from bookings by small groups and transient leisure travelers. As a result, many select service properties along highways, in small cities and in suburbs are achieving or exceeding 2019 Revenue Per Available Room (RevPAR) levels and are nearing full recovery.

Disclaimer

This commentary is provided as general information only and is in no way intended as investment advice, investment research, a research report or a recommendation. Any decision to invest or take any other action with respect to the securities discussed in this commentary may involve risks not discussed herein and such decisions should not be based solely on the information contained in this document.

Statements in this communication may include forward-looking information and/or may be based on various assumptions. The forward-looking statements and other views or opinions expressed herein are made as of the date of this publication. Actual future results or occurrences may differ significantly from those anticipated and there is no guarantee that any particular outcome will come to pass. The statements made herein are subject to change at any time. GreatX disclaims any obligation to update or revise any statements or views expressed herein.

In considering any performance information included in this commentary, it should be noted that past performance is not a guarantee of future results and there can be no assurance that future results will be realized. Some or all of the information provided herein may be or be based on statements of opinion. In addition, certain information provided herein may be based on third-party sources, which information, although believed to be accurate, has not been independently verified. GreatX and/or certain of its affiliates and/or clients hold and may, in the future, hold a financial interest in securities that are the same as or substantially similar to the securities discussed in this commentary. No claims are made as to the profitability of such financial interests, now, in the past or in the future and GreatX and/or its clients may sell such financial interests at any time. The information provided herein is not intended to be, nor should it be construed as an offer to sell or a solicitation of any offer to buy any securities. This commentary has not been reviewed or approved by any regulatory authority and has been prepared without regard to the individual financial circumstances or objectives of persons who may receive it. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

Travelers often prefer select service properties because of the value and convenience they offer. Select service average daily rates are typically lower than those at full-service hotel sand operations are more streamlined. In addition, select-service properties offer guestrooms that are often of a quality level equal to or better than that of upscale, full-service hotels with all the essential amenities, such as in-room coffee service and free Wi-Fi. While select-service hotels have only limited food and beverage service, most offer breakfast, a 24-hour grab and go snack and beverage pantry, and lobby space where guests can socialize.

From the investment perspective, because select-service hotels offer fewer services and amenities, they are easier and more efficient to operate. Fewer employees are needed to operate these hotels so labor costs, one of the most expensive components of hotel operations, tend to be meaningfully lower. As a result, select service properties generate higher and more stable operating margins than full-service hotels. Gross operating profit margins for select-service properties often exceed 40%, while those for full-service hotels are often less than 20%. The rich margins have afforded the segment downside risk protection and durable income streams through economic cycles, especially for experienced owner operators like GreatX.

Although COVID-19 has had a dramatic impact on the hospitality industry overall, select service hotels have been second only to extended stay properties in leading the post-COVID lodging recovery. From an occupancy perspective, because select service hotels are less dependent on group business, they benefit from more consistent demand than other segments. It is expected that this occupancy trend will be aided by continued limited new construction driven by increased building costs and supply chain constraints. In addition, today’s high inflationary environment is leading to higher average daily rates, resulting in increased top line revenue for these properties. This, coupled with the skinny operating expenses associated with select-service hotels is resulting in operating margin recovery. While CBD business travel is still slow, select service properties are benefitting from bookings by small groups and transient leisure travelers. As a result, many select service properties along highways, in small cities and in suburbs are achieving or exceeding 2019 Revenue Per Available Room (RevPAR) levels and are nearing full recovery.

Disclaimer

This commentary is provided as general information only and is in no way intended as investment advice, investment research, a research report or a recommendation. Any decision to invest or take any other action with respect to the securities discussed in this commentary may involve risks not discussed herein and such decisions should not be based solely on the information contained in this document.

Statements in this communication may include forward-looking information and/or may be based on various assumptions. The forward-looking statements and other views or opinions expressed herein are made as of the date of this publication. Actual future results or occurrences may differ significantly from those anticipated and there is no guarantee that any particular outcome will come to pass. The statements made herein are subject to change at any time. GreatX disclaims any obligation to update or revise any statements or views expressed herein.

In considering any performance information included in this commentary, it should be noted that past performance is not a guarantee of future results and there can be no assurance that future results will be realized. Some or all of the information provided herein may be or be based on statements of opinion. In addition, certain information provided herein may be based on third-party sources, which information, although believed to be accurate, has not been independently verified. GreatX and/or certain of its affiliates and/or clients hold and may, in the future, hold a financial interest in securities that are the same as or substantially similar to the securities discussed in this commentary. No claims are made as to the profitability of such financial interests, now, in the past or in the future and GreatX and/or its clients may sell such financial interests at any time. The information provided herein is not intended to be, nor should it be construed as an offer to sell or a solicitation of any offer to buy any securities. This commentary has not been reviewed or approved by any regulatory authority and has been prepared without regard to the individual financial circumstances or objectives of persons who may receive it. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

About the Author

Dipika Patel

Co-Founder

GreatX

Co-Founder

Dipika Patel leads GreatX as co-founder and a member of the board. A third-generation hotelier, Dipika comes with extensive experience in hotel asset investment. She is detail-oriented and has a strategic eye for all things financial. In her previous roles, Dipika has displayed innovation and leadership at its finest.

About the Company

Join us and experience a better way of owning long-term return-yielding assets in the U.S.

GreatX belongs to the family of GreatOne