The Rapid Rise of Crypto

Lakshmi Narayanan

Co-Founder

GreatX

Co-Founder

- Location: USA

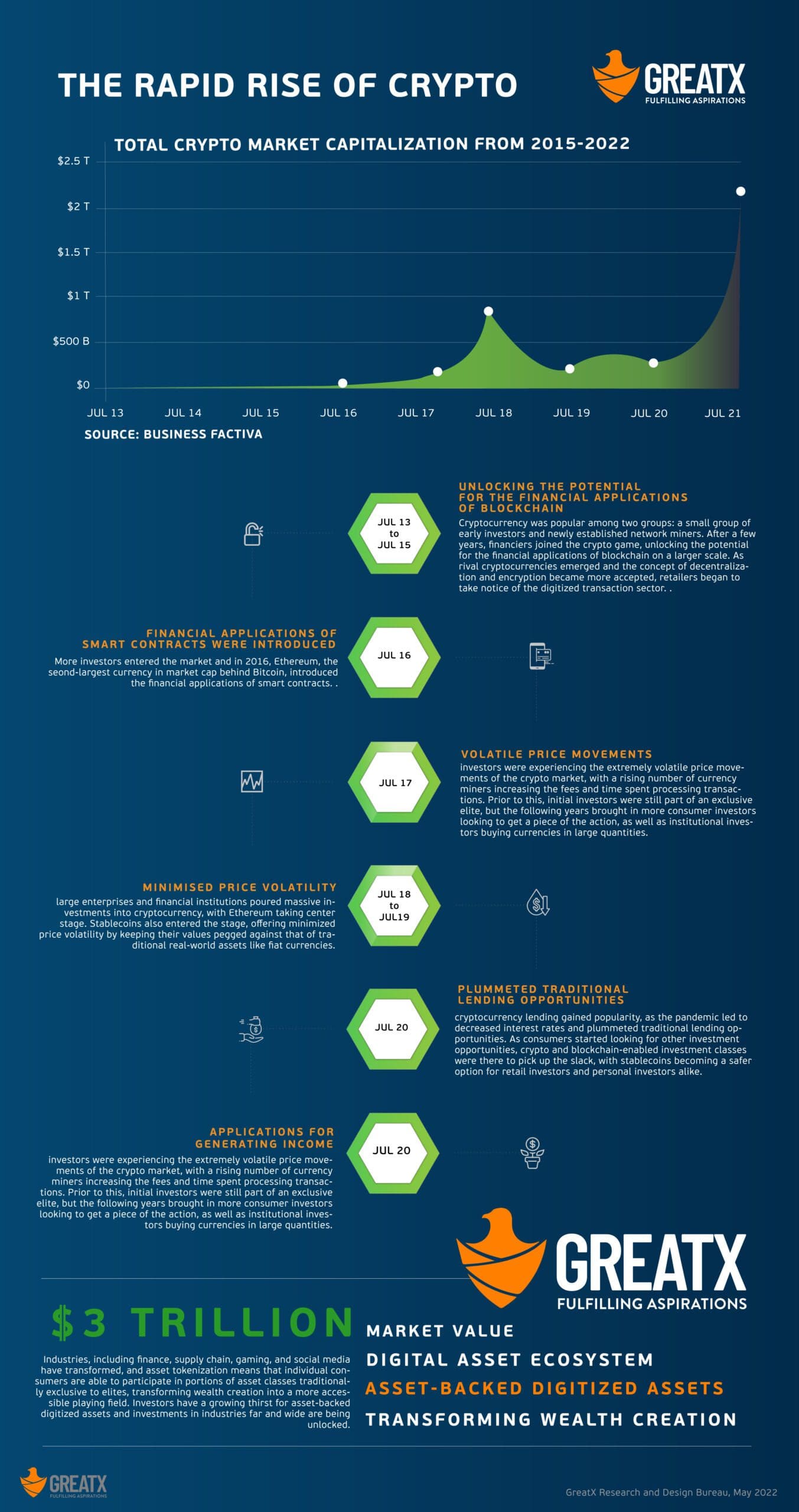

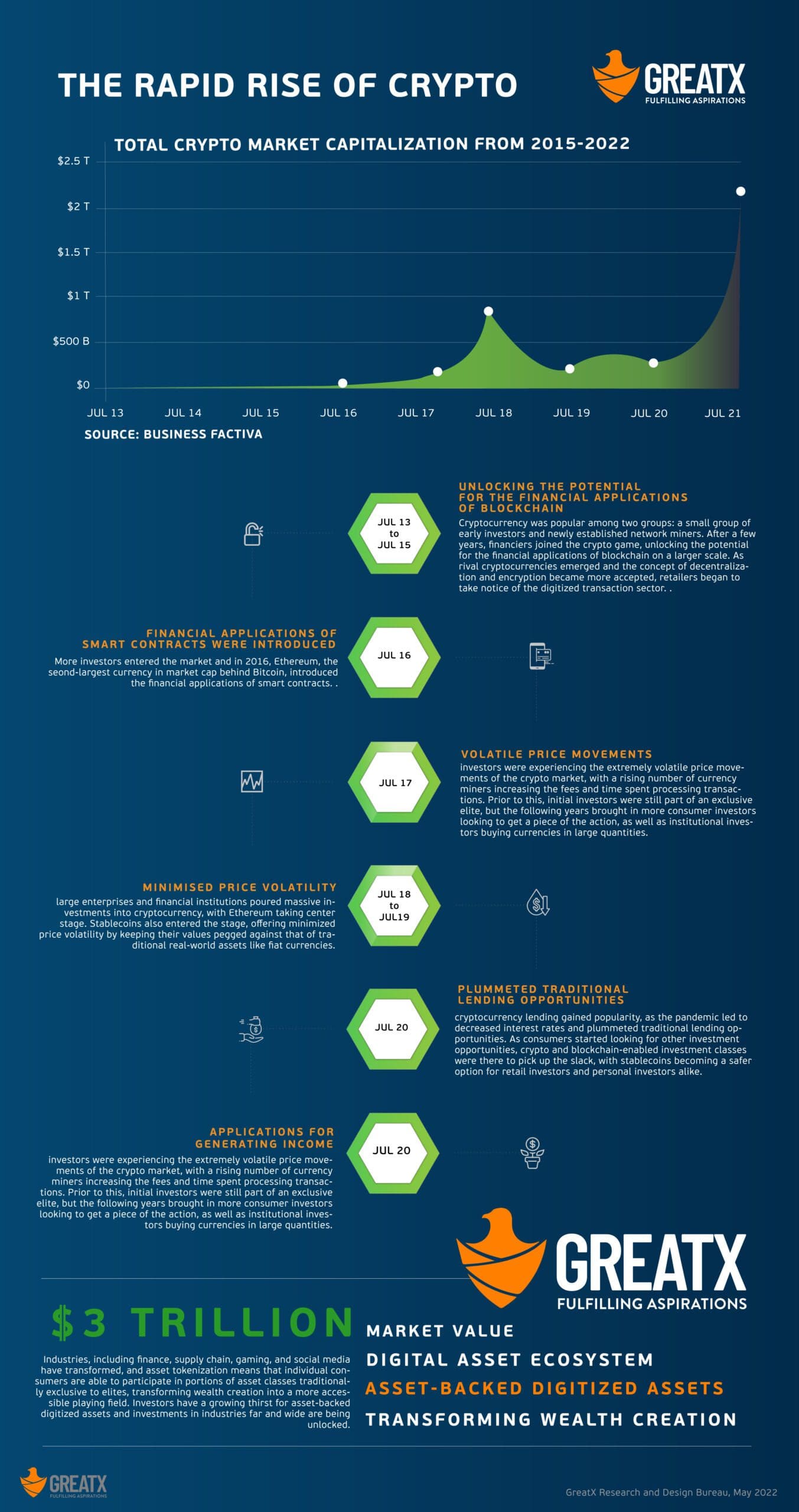

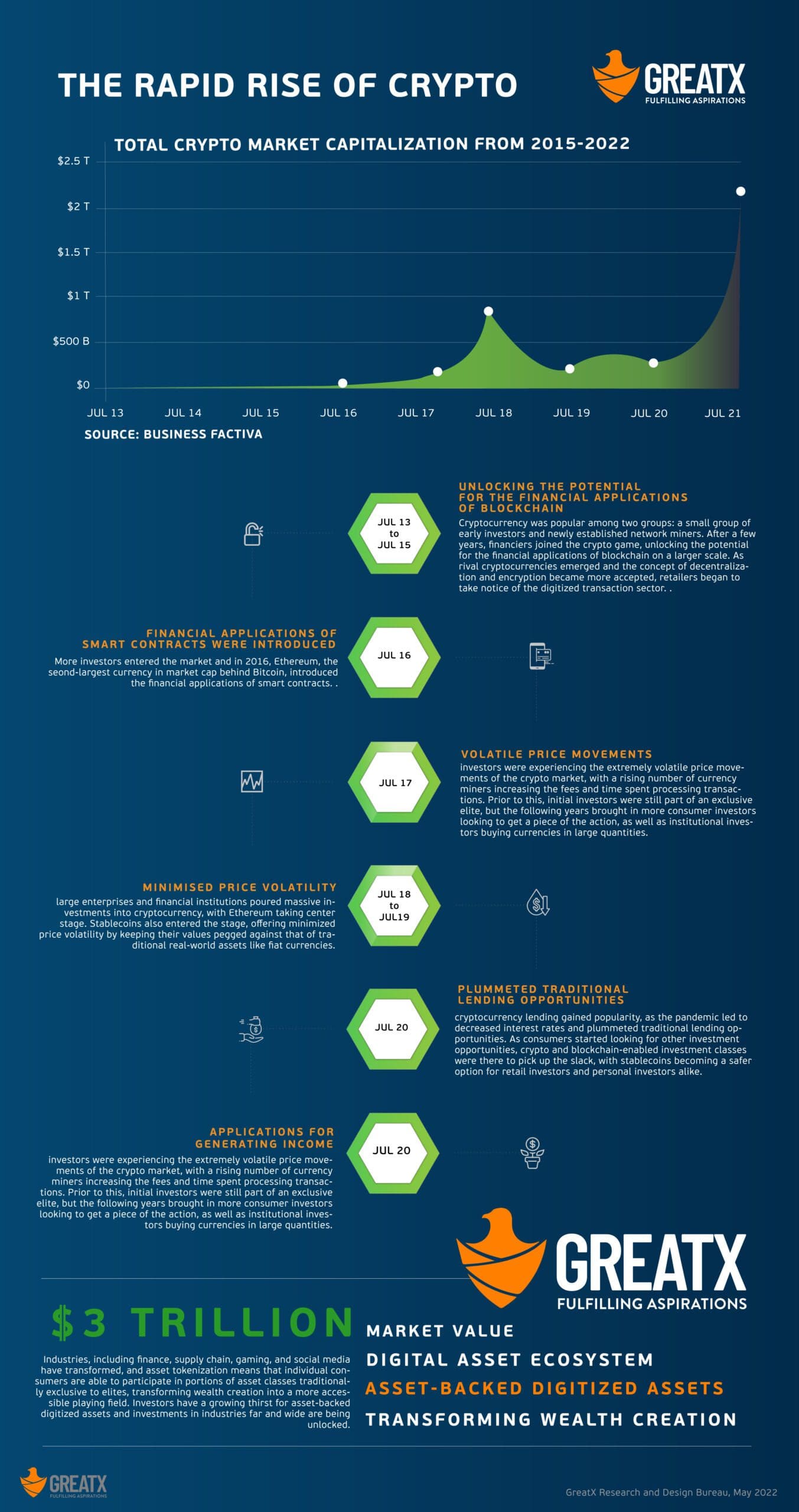

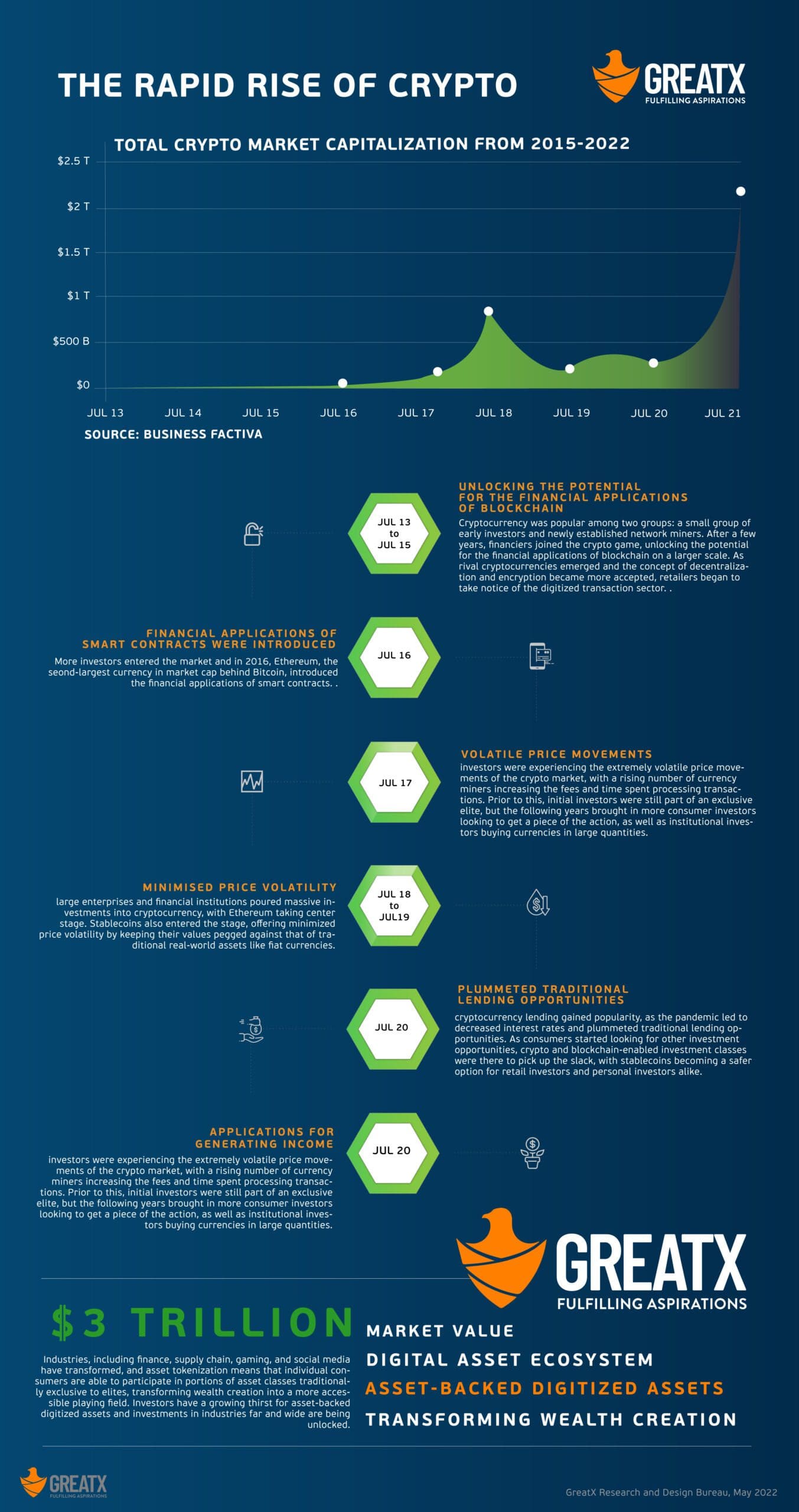

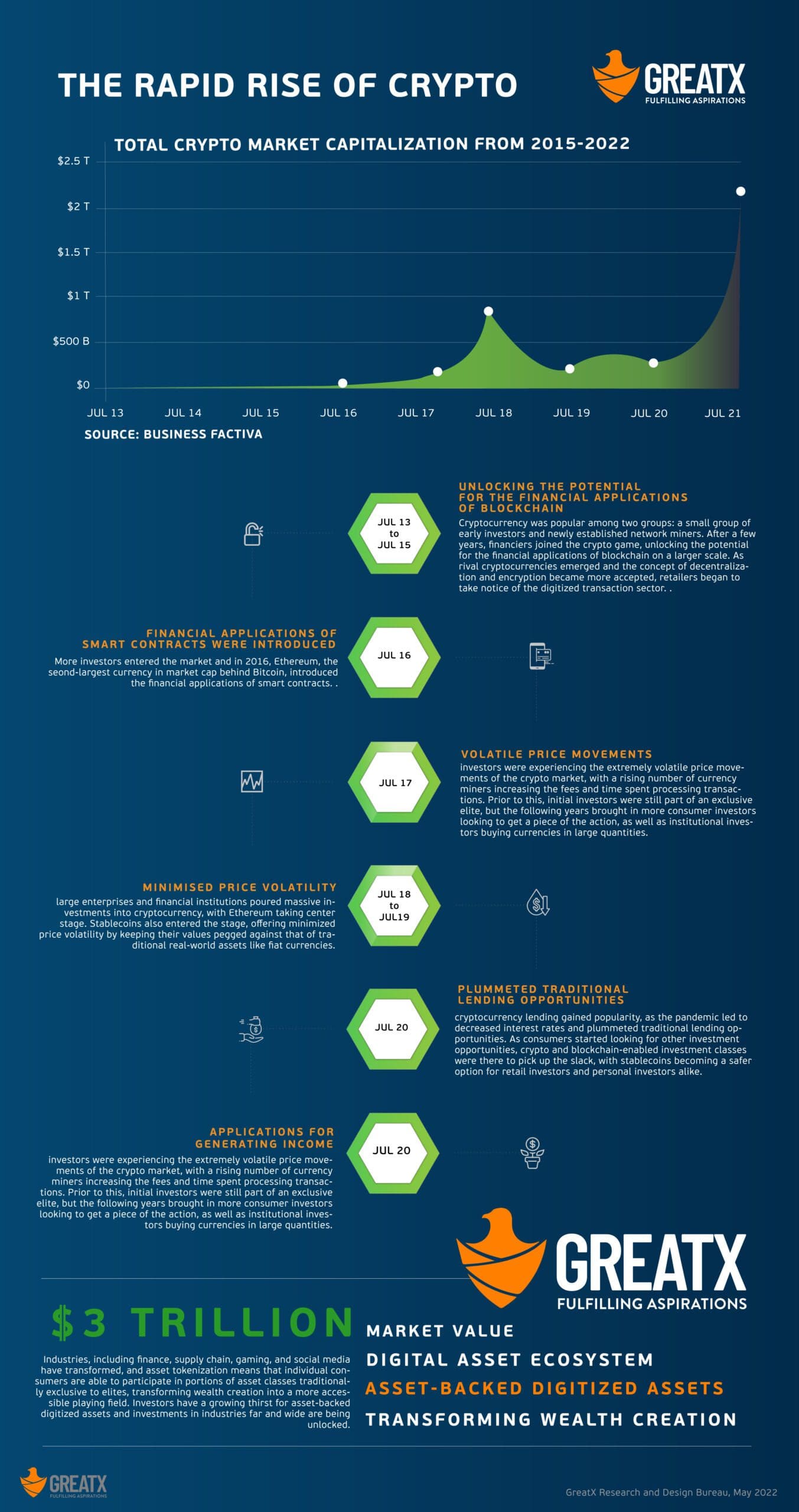

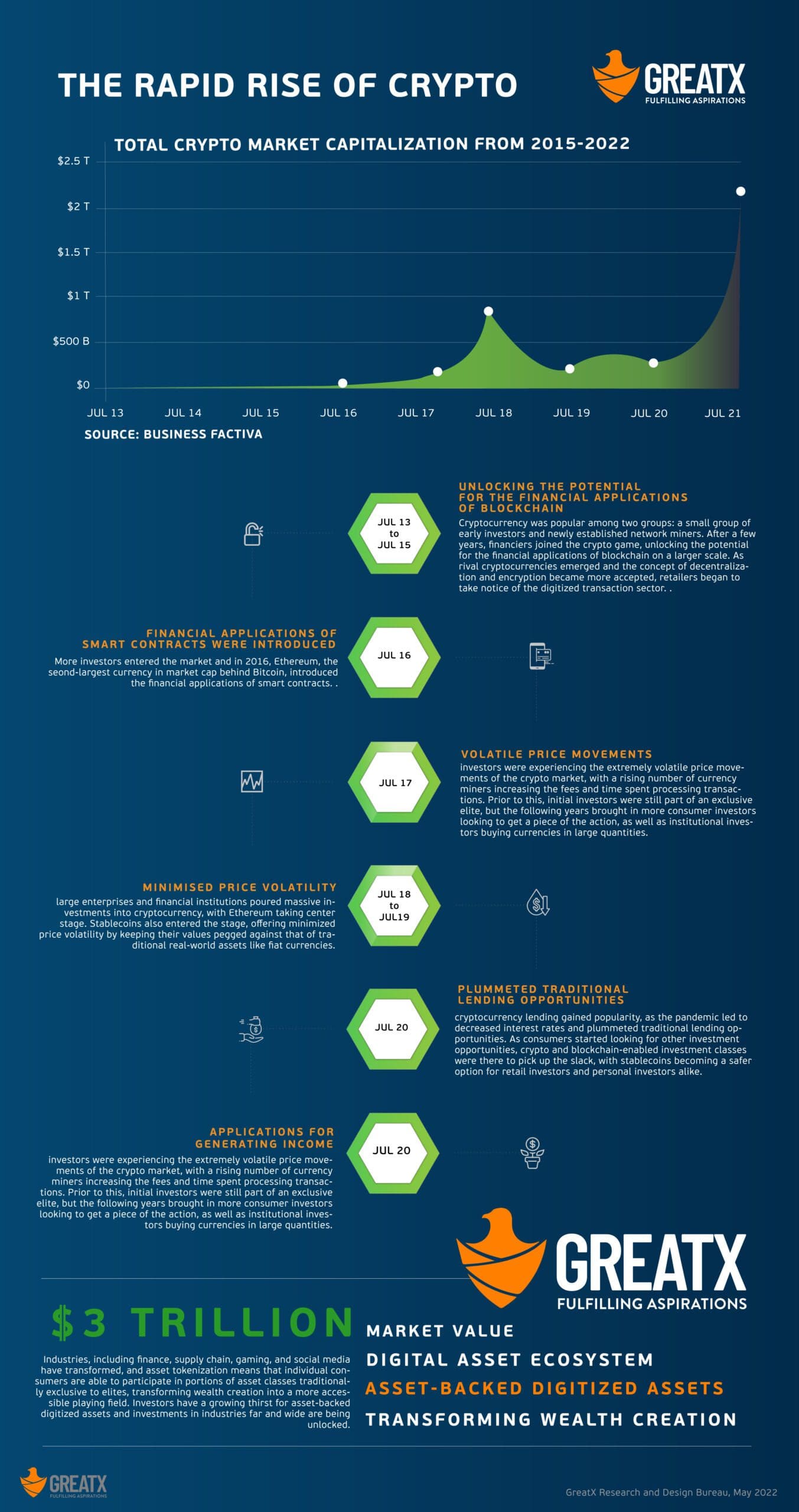

Over ten years ago, cryptocurrencies emerged as a new academic concept, which attracted the interest of the technical community. Following Bitcoin’s creation in 2009, the applications of blockchain technology were unlocked and the cryptocurrency market started gaining traction in various facets of business, government, supply chain, and finance.

Following the banking crisis, Bitcoin’s decentralized framework provided investors with a revolutionary method to process transactions.

At its early stages, cryptocurrency was popular among two groups: a small group of early investors and newly established network miners. After a few years, financiers joined the crypto game, unlocking the potential for the financial applications of blockchain on a larger scale. As rival cryptocurrencies emerged and the concept of decentralization and encryption became more accepted, retailers began to take notice of the digitized transaction sector.

More investors entered the market and in 2016, Ethereum, the second-largest currency in market cap behind Bitcoin, introduced the financial applications of smart contracts.

At this stage, investors were experiencing the extremely volatile price movements of the crypto market, with a rising number of currency miners increasing the fees and time spent processing transactions. Prior to this, initial investors were still part of an exclusive elite, but the following years brought in more consumer investors looking to get a piece of the action, as well as institutional investors buying currencies in large quantities.

Following a crypto market crash in 2018, large enterprises and financial institutions poured massive investments into cryptocurrency, with Ethereum taking center stage. Stablecoins also entered the stage, offering minimized price volatility by keeping their values pegged against that of traditional real-world assets like fiat currencies.

In 2020, cryptocurrency lending gained popularity, as the pandemic led to decreased interest rates and plummeted traditional lending opportunities. As consumers started looking for other investment opportunities, crypto and blockchain-enabled investment classes were there to pick up the slack, with stablecoins becoming a safer option for retail investors and personal investors alike.

Since 2020, new applications of financial technologies for generating income have rapidly emerged, with crypto and blockchain’s place in the market cemented. The average investor and investment firm now have a diversified portfolio incorporating cryptocurrencies and stablecoins. Investors are increasingly engaging in new ways to invest in asset-backed digital assets.

Crypto-based digital assets now have an almost $3 Trillion market value and have formed a new asset class. Since its inception, the traditionally Bitcoin-centric market has developed into a digital asset ecosystem.

Industries, including finance, supply chain, gaming, and social media have transformed, and asset tokenization means that individual consumers are able to participate in portions of asset classes traditionally exclusive to elites, transforming wealth creation into a more accessible playing field. Investors have a growing thirst for asset-backed digitized assets and investments in industries far and wide are being unlocked.

GreatX is revolutionizing crypto acceptance globally with digital assets backed by the U.S. Treasury Bonds.

Disclaimer

This commentary is provided as general information only and is in no way intended as investment advice, investment research, a research report or a recommendation. Any decision to invest or take any other action with respect to the securities discussed in this commentary may involve risks not discussed herein and such decisions should not be based solely on the information contained in this document.

Statements in this communication may include forward-looking information and/or may be based on various assumptions. The forward-looking statements and other views or opinions expressed herein are made as of the date of this publication. Actual future results or occurrences may differ significantly from those anticipated and there is no guarantee that any particular outcome will come to pass. The statements made herein are subject to change at any time. GreatX disclaims any obligation to update or revise any statements or views expressed herein.

In considering any performance information included in this commentary, it should be noted that past performance is not a guarantee of future results and there can be no assurance that future results will be realized. Some or all of the information provided herein may be or be based on statements of opinion. In addition, certain information provided herein may be based on third-party sources, which information, although believed to be accurate, has not been independently verified. GreatX and/or certain of its affiliates and/or clients hold and may, in the future, hold a financial interest in securities that are the same as or substantially similar to the securities discussed in this commentary. No claims are made as to the profitability of such financial interests, now, in the past or in the future and GreatX and/or its clients may sell such financial interests at any time. The information provided herein is not intended to be, nor should it be construed as an offer to sell or a solicitation of any offer to buy any securities. This commentary has not been reviewed or approved by any regulatory authority and has been prepared without regard to the individual financial circumstances or objectives of persons who may receive it. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

Following the banking crisis, Bitcoin’s decentralized framework provided investors with a revolutionary method to process transactions.

At its early stages, cryptocurrency was popular among two groups: a small group of early investors and newly established network miners. After a few years, financiers joined the crypto game, unlocking the potential for the financial applications of blockchain on a larger scale. As rival cryptocurrencies emerged and the concept of decentralization and encryption became more accepted, retailers began to take notice of the digitized transaction sector.

More investors entered the market and in 2016, Ethereum, the second-largest currency in market cap behind Bitcoin, introduced the financial applications of smart contracts.

At this stage, investors were experiencing the extremely volatile price movements of the crypto market, with a rising number of currency miners increasing the fees and time spent processing transactions. Prior to this, initial investors were still part of an exclusive elite, but the following years brought in more consumer investors looking to get a piece of the action, as well as institutional investors buying currencies in large quantities.

Following a crypto market crash in 2018, large enterprises and financial institutions poured massive investments into cryptocurrency, with Ethereum taking center stage. Stablecoins also entered the stage, offering minimized price volatility by keeping their values pegged against that of traditional real-world assets like fiat currencies.

In 2020, cryptocurrency lending gained popularity, as the pandemic led to decreased interest rates and plummeted traditional lending opportunities. As consumers started looking for other investment opportunities, crypto and blockchain-enabled investment classes were there to pick up the slack, with stablecoins becoming a safer option for retail investors and personal investors alike.

Since 2020, new applications of financial technologies for generating income have rapidly emerged, with crypto and blockchain’s place in the market cemented. The average investor and investment firm now have a diversified portfolio incorporating cryptocurrencies and stablecoins. Investors are increasingly engaging in new ways to invest in asset-backed digital assets.

Crypto-based digital assets now have an almost $3 Trillion market value and have formed a new asset class. Since its inception, the traditionally Bitcoin-centric market has developed into a digital asset ecosystem.

Industries, including finance, supply chain, gaming, and social media have transformed, and asset tokenization means that individual consumers are able to participate in portions of asset classes traditionally exclusive to elites, transforming wealth creation into a more accessible playing field. Investors have a growing thirst for asset-backed digitized assets and investments in industries far and wide are being unlocked.

GreatX is revolutionizing crypto acceptance globally with digital assets backed by the U.S. Treasury Bonds.

Disclaimer

This commentary is provided as general information only and is in no way intended as investment advice, investment research, a research report or a recommendation. Any decision to invest or take any other action with respect to the securities discussed in this commentary may involve risks not discussed herein and such decisions should not be based solely on the information contained in this document.

Statements in this communication may include forward-looking information and/or may be based on various assumptions. The forward-looking statements and other views or opinions expressed herein are made as of the date of this publication. Actual future results or occurrences may differ significantly from those anticipated and there is no guarantee that any particular outcome will come to pass. The statements made herein are subject to change at any time. GreatX disclaims any obligation to update or revise any statements or views expressed herein.

In considering any performance information included in this commentary, it should be noted that past performance is not a guarantee of future results and there can be no assurance that future results will be realized. Some or all of the information provided herein may be or be based on statements of opinion. In addition, certain information provided herein may be based on third-party sources, which information, although believed to be accurate, has not been independently verified. GreatX and/or certain of its affiliates and/or clients hold and may, in the future, hold a financial interest in securities that are the same as or substantially similar to the securities discussed in this commentary. No claims are made as to the profitability of such financial interests, now, in the past or in the future and GreatX and/or its clients may sell such financial interests at any time. The information provided herein is not intended to be, nor should it be construed as an offer to sell or a solicitation of any offer to buy any securities. This commentary has not been reviewed or approved by any regulatory authority and has been prepared without regard to the individual financial circumstances or objectives of persons who may receive it. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

Lakshmi Narayanan, the co-founder at GreatX, is a passionate investor and serial entrepreneur who in a span of 15 years has revolutionized the way real estate and asset management works. Lakshmi has founded and led several successful organizations and brought innovation at its finest, paving way for visionary ideas and products.

About the Company

Join us and experience a better way of owning long-term return-yielding assets in the U.S.

GreatX belongs to the family of GreatOne